Executive summary

Recent challenges have emphasised the recurring importance of the energy trilemma, namely the need to decarbonise the energy system while ensuring energy security and affordability. The government announced its Review of Electricity Market Arrangements (REMA) in April 2022 to address these issues. In July, the government published a consultation paper for REMA, presenting a number of proposed reforms.

This paper helps to shed light on this topic, breaking down key proposals and explaining their potential benefits and areas of concern. The main paper findings are as follows:

- Existing market arrangements brought about through the British Energy Trading and Transmission Arrangements (BETTA) need updating, especially given the current overlaying of renewable subsidies which has led to the development of inefficiencies and challenges.

- The current macroeconomic climate is increasingly restrictive in terms of monetary policy and European countries are having to compete to attract global investment. Hence it is critical to ensure that the opinions of investors and developers are considered in any future market design.

- The government has proposed a large number of options for consideration. At present, market splitting and locational pricing are the two proposals receiving the most attention.

- Market splitting would see a move from a single national wholesale price to twin wholesale prices, splitting intermittent renewables from other generation types.

- Renewables and fossil fuel electricity generation would be significantly impacted by this model as prices for these generators are currently set by gas fuelled generation assets which determine the marginal price for electricity.

- Renewables launched under the Contracts for Difference (CfD) scheme and flexible assets would see less of an impact as prices for these generators are set by the scheme itself.

- Market splitting would see a move from a single national wholesale price to twin wholesale prices, splitting intermittent renewables from other generation types.

- Locational pricing looks to introduce more granular prices, each better reflecting the capacity and constraints of the network at the point they apply to. This would aim to overcome issues around investment signals not reflecting network conditions.

- Our modelling finds that locational pricing would have a significant impact on prices in Scotland, and a limited impact in England and Wales. Given the high proportion of wind generation in Scotland, locational pricing is likely to result in significant savings for GB consumers. Meanwhile, solar generators and offshore wind farms located on the East Coast of England will be less affected.

- With regards to timescales, it would take at least 2-3 years, potentially longer, to implement, given the changes to IT systems required, and impact on forward wholesale contracts.

- A nodal approach to locational pricing may not be effective for encouraging suitable investment in new renewables as factors beyond location which are import for developing newer technologies may not be sufficiently accounted for.

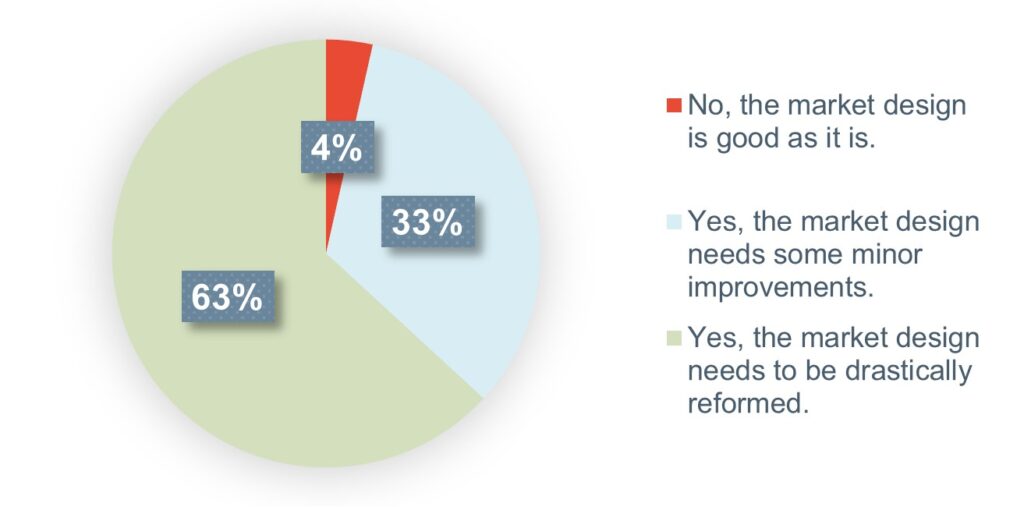

- At our 12 July Financing Net Zero forum, a poll undertaken by forum attendees revealed that the majority of respondents agree that the market needs to be drastically reformed, with a further third identifying the need for minor improvements. Only 4% deemed the current market design good as it is.

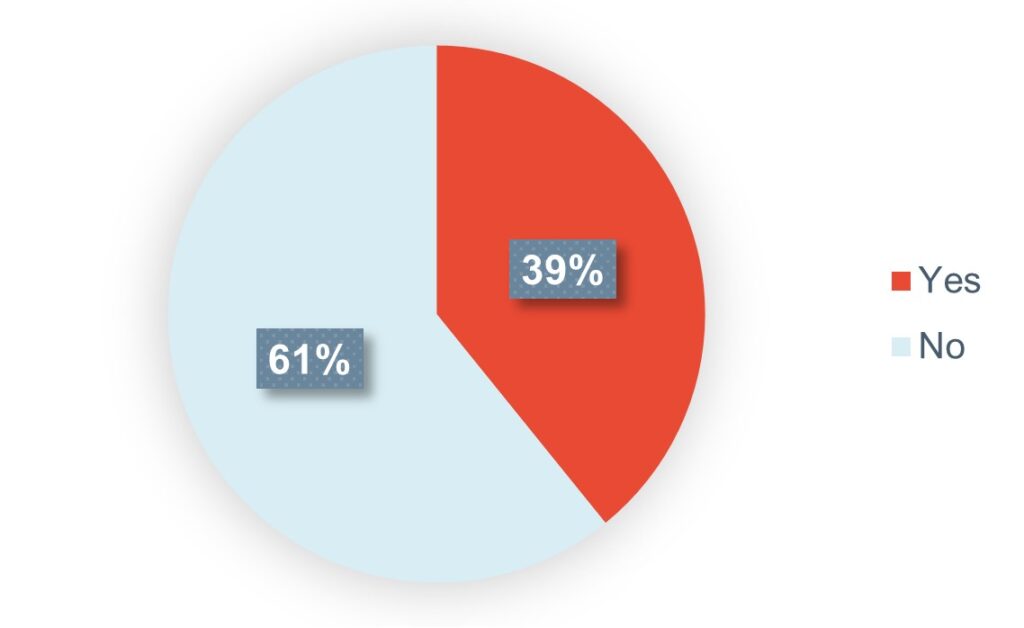

- A later webinar, on 27 July, hosted after the consultation had been published, looked more specifically at locational pricing, revealing a more pessimistic view of this proposal, with the majority of our respondents disagreeing that it was the best option to proceed with.

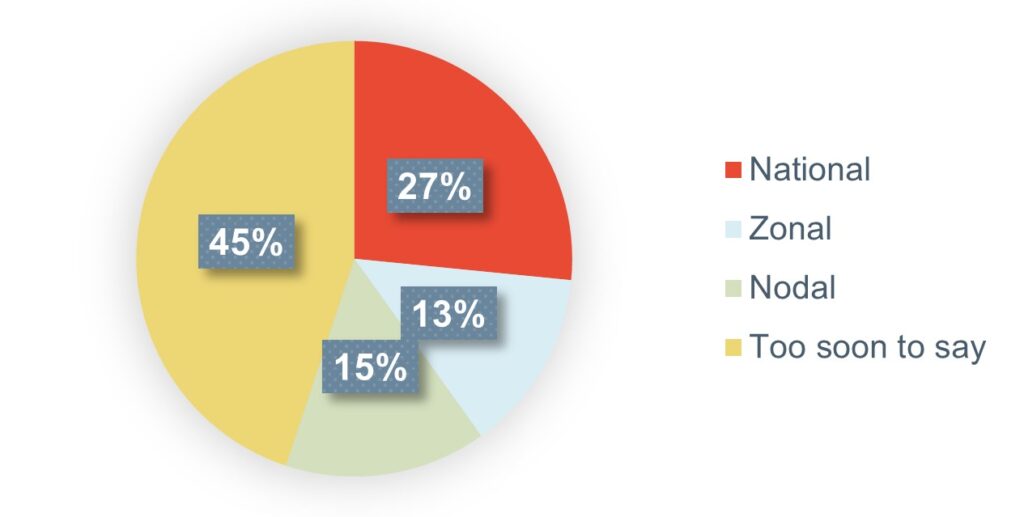

- There was further caution around what form of pricing is best for organisations participating in the polling, with 45% of our respondents opting for “too soon to say”, 27% choosing “national” and only 15% choosing “nodal” and 13% “zonal.

1. Why REMA?

REMA looks to resolve and attend to inefficiencies which have been identified within the GB energy markets. The review was announced in the British Energy Security Strategy in April 2022.

In terms of scope, it considers options for reform to non-retail aspects of electricity markets. It aims to take a closer look into the structures which facilitate the balancing of supply and demand of electricity, and the policies that are meant to incentivise investments in the assets that generate or use electricity. More specifically, the scope of REMA includes the balancing mechanism, ancillary services, the current CfD scheme, and the Capacity Market (CM).

Introduced following the privatisation of the electricity markets in 1989, the legal framework of Pooling and Settlement Agreement (PSA) provided the outlines for the Pool trading mechanism in the UK. The Pool trading mechanism (or Power Pool) was a mandatory market in which electricity generators offered power into the Pool at the day ahead stage, which was cleared and centrally dispatched. Suppliers paid the cleared half-hourly Pool price which included a capacity payment.

Ultimately it was found that this mechanism permitted some anti-competitive behaviour, and it was hence reformed in the 1990s resulting in NETA reforms.

The review’s scope will not include non-electricity markets (such as hydrogen, gas, and carbon), retail markets, incentives for new technologies, interconnectors, and large-scale nuclear investment.

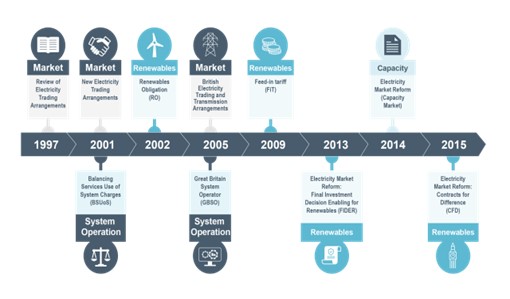

The current market design, which is under review in the REMA consultation, has its roots in regulatory interventions that have taken place across the last three decades (see Figure 1).

In 1998, the New Electricity Trading Arrangement (NETA) reforms were first proposed by Government and later implemented in 2001. Four years later, in 2005, British Electricity Trading and Transmission Arrangements (BETTA) were implemented, expanding NETA from England and Wales to Scotland, and establishing a single electricity market in Great Britain.

The intention of the NETA and BETTA reforms were to encourage competition and efficiency in national energy markets by introducing bilateral contracts and self-dispatch to replace the more centralised Pool trading mechanism which existed in the market prior to 1998 (see Box 1).

The system introduced by BETTA has been in place for the best part of a decade as renewables have gained critical mass (see Figure 1). In 2002, the Renewable Obligation (RO) was introduced as the main means at the time to incentivise scale renewables, culminating in around 30GW of new plant. Later, in 2011, in order to attract investment to the scale of renewables required to meet 2020 targets (and beyond), and to resolve an expected gap between forecasted demand and generation, the then Department of Energy & Climate Change (DECC) began the Electricity Market Reform (EMR) programme. This introduced two major new policies which were layered on top of the BETTA system, namely, the CfD and CM. These schemes further shaped market arrangements and draw us to the present market.

While the existing market arrangements have helped to deliver significant amounts of low-carbon capacity, the growth of renewables is leading to an increased mismatch between our trading arrangements, which were designed for a fossil fuel-based energy system, and the market’s new core technologies.

The REMA consultation paper, published in July 2022, identifies the following as the key challenges to the UK energy markets:

- Price cannibalisation, whereby market design results in the zero marginal cost nature of renewable electricity plants displacing high-cost generation in the merit order[1], resulting in a depressive impact on wholesale markets. This in turn results in the wholesale market revenues alone not being sufficient to deliver the unprecedented volumes of investment required to scale up renewables. We discussed this topic further in our insight paper on the ‘Net Zero Paradox’.

- Missing money, whereby generators are not able to earn enough revenue from the energy markets to cover their costs of investing in the generation and operating of plants.

- Lack of sufficiently granular price signals, with the location of power generation not being suitably represented in market pricing leading to less efficient developments.

- Lack of investment signals for low carbon flexibility, with limited access to revenues from the market itself for flexible assets and prices currently set by the most expensive generators, which is usually gas.

Moreover, these issues prove to be even more concerning when we consider the direction of macroeconomic trends across Europe. At present, we are seeing a move from the phase of relative abundance of cheap capital that followed the 2008 Global Financial Crisis to a period of restrictive monetary policies aimed at combating high inflation. Investors operating internationally will be looking for markets with stable and market-friendly regimes, as well as healthy deal pipelines in the long-term. It is therefore critical that the Government review the market arrangements as they stand, in order to ensure they are fit for purpose and effective in attracting future capital and ensuring the three points of the energy trilemma are satisfied[2].

2. Key REMA proposals

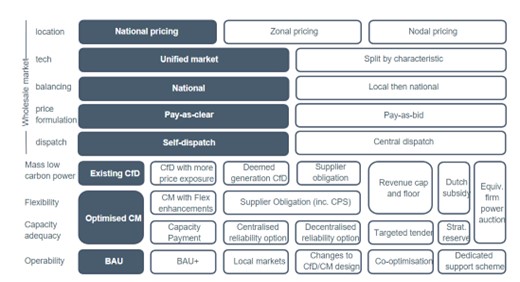

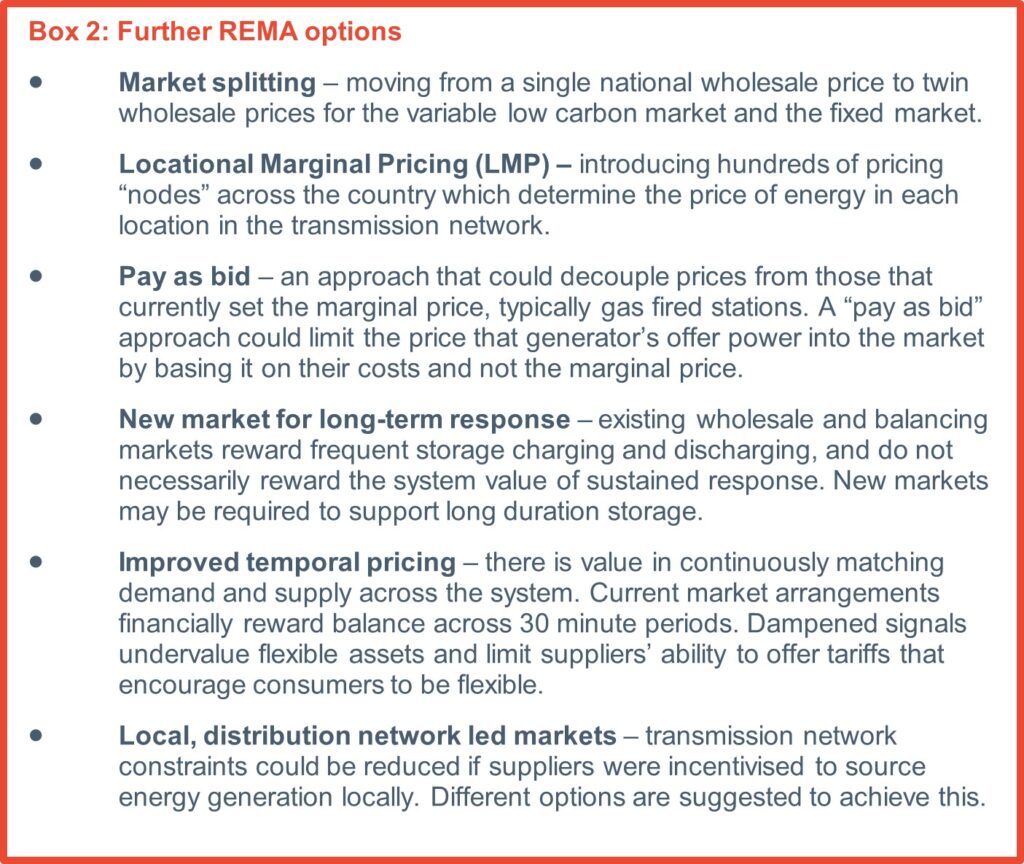

REMA is still in its early stages and the initial consultation period runs until 10 October 2022. At present, proposals are illustrative rather than exhaustive and some concepts are still theoretical or might not have been used in an energy system with GB’s features. Box 2 and Figure 2 help to outline some of the key options under discussion at the moment.

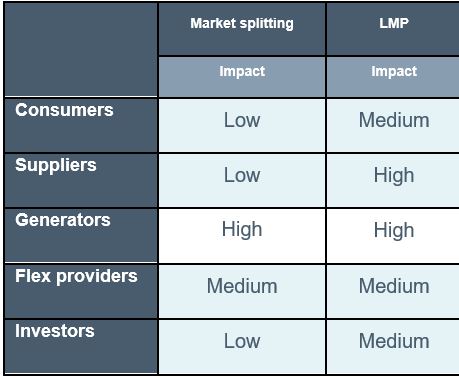

The two leading options at present are the move to a central dispatch locational pricing system and market splitting. The following sections explore these two options and their impact on key industry players (see Figure 3).

Market splitting would see a move from a single national wholesale price to twin wholesale prices, splitting intermittent, variable renewables from other generation types.

Prices for the variable renewable market would be determined via long-term agreements and be close to the long-run marginal cost (see Box 3) of the renewables participating. This would better reflect the cost nature of renewable assets: they have high long-run costs in the building process, but once running, have low operating costs.

In the firm power market, made up largely of non-renewable energy sources, prices would continue to be set by the short-run marginal cost of the assets which can ensure demand is met, usually gas fired power.

By splitting these markets, the price of renewable energy would be separated from the increasingly high gas fired power and renewables would operate in a market better suited to their cost structures. This option would be particularly helpful for resolving the longer-term market challenges related to price cannibalisation and lack of investment signals for low carbon flexibility, mentioned in section 2.

Impact for renewable generators

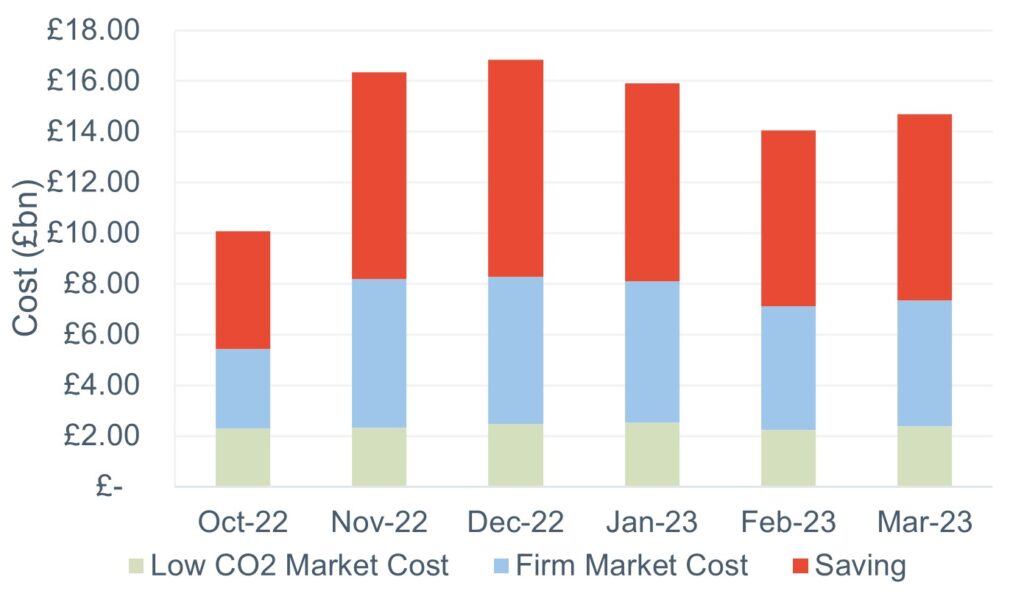

Cornwall Insight completed modelling on the impact of market splitting using average monthly load factors and demand from last winter. This modelling was applied to monthly winter prices across 2022 – 2023[3].

The results of this analysis found that older renewable capacity – deployed under the RO and Feed-in-Tariff (FiT) schemes – would earn £87.9bn between October 2022 and March 2023, at current monthly prices (see Figure 4). This would reduce the impact of high marginal prices set by gas fuelled generation assets.

Newer renewable assets in GB which are deployed under the CfD will see less of an impact. The CfD already effectively sets prices on the same mechanism proposed for the renewable element of the split market, based on their long-run marginal cost. Therefore, for new assets there will be limited impacts, beyond potential implications for the small percentage of overall revenues generated in the merchant nose and tail.

Source: Cornwall Insight

Impact for flexibility providers

Flexibility providers are unlikely to see significant impacts from a split wholesale market. Under the proposed approach flexible providers (such as batteries and gas peakers) would compete in a near term wholesale market priced according to short-run marginal cost. This is similar to how flexibility providers currently price, trade and optimise their assets between wholesale market and balancing service provision.

2.2 Locational pricing

Locational pricing would introduce a more granular set of prices, each better reflecting the capacity and losses of the network at the point they apply, acting as an incentive when choosing locations for generator or consumer developments.

This aims to overcome issues around investment signals, in particular regarding where new plants should be developed, and ensuring sufficiently granular pricing, considering concurrently the value of energy and network conditions, e.g., losses and constraints. There are two approaches with locational pricing, namely, zonal pricing and nodal pricing (also known as Locational Marginal Pricing (LMP)).

Zonal pricing would see the network split into clearly designated zones. Each zone has a single price which, like the national price, does not assume varied constraints within the zone. This model is seen as somewhat of a halfway house between the current market design and nodal pricing: removing some complexity by having a single price for each regional zone, but at the same time allowing the pricing of electricity flowing between zones to reflect the relative network constraints.

Nodal pricing, or LMP, would introduce hundreds of pricing “nodes” across the country, which would determine the price of energy in each location in the transmission network. These nodal prices would reflect the constraints of the network in the different areas.

The implementation of nodal pricing with central dispatch in the UK would require complex design choices that would need careful consideration to ensure inflexible, vulnerable, and fuel-poor consumers were not disproportionately impacted.

The LMP market design is unlikely to deliver change within the next two-to-three years. The changes to IT systems necessary for this shift would require a significant lead time, which the National Grid Electricity System Operator estimates would take around five years, not to mention the need to design new LMP-compliant capacity and renewables support schemes.

Impact for renewable generators

Locational pricing could have a significant impact on generators, especially those located in the North (Figure 5). When LMP is applied to the UK transmission system through our modelling the findings are that prices are quite diverse in Scotland. However, over much of England and Wales the prices are very similar. As most wind generation capacity is located in Scotland, there could be a significant saving for UK consumers, while solar generators and offshore wind farms located on the East Coast of England will be less affected.

For new assets this would expose developers to the effects of their decisions of where to locate, and would incentivise different behaviour, such as encouraging changes in demand, investing in storage assets, or moving to different siting locations. The counterargument is that generators would be exposed to hard to forecast costs, increasing the difficulty of investment and jeopardising the future investment necessary to meet decarbonisation targets.

For existing assets, it would mean that those in higher demand areas may see increased wholesale prices (and therefore a positive benefit) and those in areas with excess generation compared to local demand could see lower prices (and therefore a negative outcome).

With regards specifically to the more granular nodal pricing, new low-carbon generation technologies such as nuclear, offshore wind, and carbon capture, utilisation and storage (CCUS) may not develop in the most suitable or efficient places under this system. For these technologies, there are other important factors which need to be considered besides locational pricing, such as flexible constraints around planning, space availability and broader infrastructure, and consumer or supply integration. Under the nodal system developers might be discouraged from giving these factors their due consideration given that prices would be so heavily influenced by location and grid congestion. This may result in less efficient development of these new technologies, undermining the very purpose of locational pricing.

Impact for flexibility providers

As with generators, flexibility providers will see a mixed picture as a result of locational pricing, depending on their location and therefore the expected nodal or zonal price. This will create winners and losers; however, the impact may be smaller for battery assets than other flexible generators. While a low price reduces export returns it also reduces import costs (and vice versa for higher prices), potentially supporting overall project returns. Compared to this, other flexible assets may risk seeing lower prices if they are in a generation heavy area where they are not able to recoup their higher short-run marginal costs.

Impact on security of supply

It is unclear whether a market with locational pricing would improve security of supply or reduce reliance on imports of gas and power. Interconnectors might be more effectively located but building capacity in GB itself could become more complicated as the increased volatility of wholesale power prices reduces the visibility and bankability of generator revenues. Although locational pricing theoretically could help to locate new generation more efficiently, leading to optimal dispatch and more efficient transmission network investment, there are evidently concerns that this may not be how it plays out in practice.

What is more, with every far-reaching reform there is a risk of investment hiatus and disruption, or even negative impacts on sunk investments. It is clear that if locational pricing is an option that is pursued, there will need to be more work done to carry the industry and investors along for the ride, and in particular to convince people that returns will not be adversely impacted on existing projects.

3. The market view

As global trends prompt an increasingly restrictive environment for investment in renewables, the views of the investor and financial communities are critical to ensuring that the outcomes of REMA support the UK’s competitiveness as a jurisdiction for renewables investment.

(The survey took place on 12 July 2022, and 114 of 177 attendees responded)

Cornwall Insight’s Financing Net Zero forums bring together these financial players to reflect and discuss on key issues of the day. In July 2022, two forums were held exploring REMA and its impacts. The first forum took place on 12 July, and the second on 27 July. While the first webinar presented an overview of the issues under the discussion, the second event – broadcasted after the publication of the REMA consultation – offered an opportunity to dissect in detail the key elements of the proposed reform. On both occasions, we asked our audience for their opinions on aspects of the proposed reforms.

(The survey took place on 12 July 2022, and 97 of 177 attendees responded)

During our 12 July Financing Net Zero forum, focused on “Unpicking implications of electricity market reform”, we asked our audience “Do you think that the GB electricity market design needs to be reformed?”. As shown in Figure 6, the overwhelming majority of respondents suggested that it needs to be drastically reformed, with a further third identifying the need for minor improvements, and only 4% deeming the current market design good as it is.

The second forum on 27 July offered a opportunity to assess market views on the key issues and topics to arise from the proposed reforms. One such issue being debated across the market is the potential move away from GB-wide wholesale electricity prices to costing wholesale prices on a local basis, known as nodal pricing, or LMP. While some say this will encourage energy generation to locate in lower cost areas with fewer network constraints and help ensure smooth dispatch, the majority of our respondents disagreed that this was the best option to proceed with (see Figure 7).

There have already been several studies and position papers from different stakeholders in the energy industry on this reform option, some of which are supportive and some of which are not. However, almost all contributions on this model have rightly focused on concerns that such reforms, being reasonably radical, may halt investment in the short-term and damage sunk investments if not handled with care.

(The survey took place on 27 July 2022, and 207 of 303 attendees responded

Some have gone further and argued that LMP could disrupt the energy market as it transitions, and even potentially disincentivise developers to build in places that are ideally suited to specific technologies. Our survey reveals that more traction is being gained from those who argue that LMP is not the appropriate reform option, despite this being favoured by the Energy System Operator, and recently featured as a possible reform option in an Ofgem positioning paper.

Caution around nodal pricing also emerged during our second event. During the 27 July “Understanding REMA” webinar, we asked our audience “Which pricing mechanism do you think could work best for your organisation?” While 45% of our respondents opted for “too soon to say”, 27% chose “national” and only 15% chose “nodal” and 13% “zonal” (see Figure 8).

Concluding thoughts

REMA is set to play a key role in shaping the future of the UK energy market, by designing policies that can address inefficiencies of the current model, while delivering significant amounts of low-carbon capacity at the lowest possible cost for consumers, without compromising security of supply.

Polling from our Financing Net Zero forums indicated that a majority of market players are keen to see some kind of reform of energy markets in the coming years. Principal among the suggestions from BEIS are proposals for market splitting and locational pricing. When assessing the details published so far on the latter model in our 27 July forum, our respondents noted that it was ‘too soon to say’ which approach to locational pricing might be best. Both in the forum discussions and wider industry conversations, attention has rightly focused on concerns that these reforms, being reasonably radical, need to be handled with care to ensure they do not hinder the critical investment needed in the coming years.

Indeed, given these concerns, it is imperative that the concerns of generators and investors are taken into proper consideration while designing the features of the future market design. This is even more important in the current macroeconomic climate, as we move from the phase of relative abundance of cheap capital that followed the 2008 Global Financial Crisis to a period of restrictive monetary policies aimed at combating high inflation. The ongoing increase in interest rates risks not only to plunge all G7 economies – with the likely exception of Japan – into recession, but also to significantly increase the cost of capital, thus leading to a reduction of the capital available for investment.

That means that, given Europe’s geopolitical need to emancipate itself from Russian gas, European countries will increasingly be competing to attract investment to allow them to diversify away from natural gas. Global investors will be scrutinising each country, looking for jurisdictions that can ensure stable and market-friendly regimes, as well as healthy deal pipelines in the long-term.

The UK is extremely well positioned in this respect, being widely perceived as an investor friendly jurisdiction, for example ranking 5th globally in EY’s Renewable Energy Country Attractiveness Index. However, such a traditional competitive advantage of the UK should not lead to complacency, as prolonged periods of uncertainty as well as ineffective reforms could seriously hinder the country’s attractiveness, failing to send the right investment signals. In other words, investment flows may simply go elsewhere.

Hence, when designing future energy policies, policymakers should be mindful of the current macroeconomic and geopolitical landscape to avoid the risk of exacerbating the situation and deterring investment. On the contrary, all the efforts should be made so that the new market design emerging from REMA sends the right investment signals needed to deploy capital needed to achieve net zero.

The recent Energy Price Guarantee, announced on 8 September 2022, will seek to tackle some of the immediate concerns around energy affordability for households and businesses in the coming winter. However, this fiscal support will come at a substantial cost to the UK government and therefore it is crucial that there is a well-developed exit strategy to avoid the country once again falling hostage to global gas prices once government support comes to an end in two years’ time. REMA is a key mechanism to ensure the future UK energy market is fit for purpose and thus it is important that the short-term support provided by the Energy Price Guarantee does not lead to complacency and dilute focus on REMA.

[1] Merit order refers to the sequence in which power stations are prioritised in setting prices in the power market, with the cheapest offer made by the power station with the smallest running costs setting the starting point.

[2] Review of Electricity Market Arrangements (publishing.service.gov.uk)

[3] It is unlikely that market splitting would be applied in this time frame, however the results help us to identify potential impacts on the GB market more generally.

If you would like to access all your services in our customer portal, CATALYST, please click here.