Initial options assessment

In its first REMA consultation, the government set out its emerging conclusions from its initial assessment of policy options for reform, with a number of questions set out for each option.

Options for delivering a net zero wholesale market

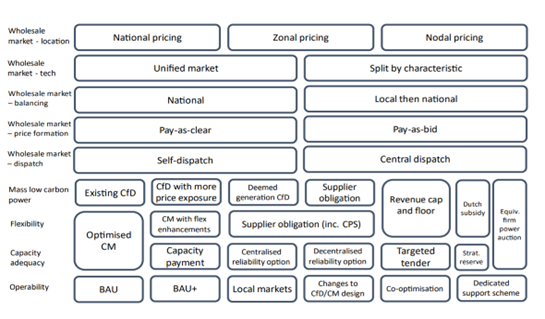

Looking at the first five rows of Figure 1, the government set out its assessment of the options for delivering a net zero wholesale market.

Source: BEIS

Approaches being considered to address challenges associated with the current market design, include:

- Splitting the market into separate markets for variable and firm power, which is primarily proposed as a solution to price cannibalisation, and the resulting price volatility.

- Note: within its second REMA consultation, the government set out its intention to remove options for splitting the market. See here for more details.

- Introducing locational pricing – either zonal or nodal.

- Note: within its second REMA consultation, the government set out its intention to remove nodal pricing. However, it is still considering zonal pricing. See here for more details.

- Reorienting the wholesale market around local, distributional level markets, either through new local market structures or locational imbalance pricing.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with locational imbalance pricing. See here for more details.

- Moving to pay-as-bid rather than existing pay-as-clear pricing, where participants would receive the price of their bids/offers rather than the bid of the highest priced supplier selected to provide supply.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with pay-as-bid pricing. See here for more details.

- Maintaining the fundamentals of the status quo, with incremental reforms of parameters, such as changes to dispatch arrangements from self-dispatch to central dispatch, changes to settlement periods and gate closure to increase temporal granularity in the market, and changes to the Balancing Mechanism.

- Note: these options are still under consideration within the government’s second REMA consultation. See here for more details.

Many of these options represent fundamental redesigns of wholesale electricity markets and would have ‘significant’ implications across the system. The government noted that business models for all market participants would be likely to change and existing support schemes would need to be updated. This includes the Contracts for Difference (CfD) and Capacity Market but also schemes such as the Dispatchable Power Agreement for power carbon capture, usage and storage (CCUS) and the Regulated Asset Base model for large-scale nuclear. The System Operator would also require new infrastructure and system changes and there would need to be changes to retail market regulation to ensure that households and large electricity users continue to be appropriately protected. As such, several of these options would likely take a number of years to fully design and implement.

Options for delivering mass low carbon power

The government set out its assessment of the options for delivering mass low carbon power, noting that ‘significant’ investment will be needed to meet the 2035 decarbonisation target. Approaches being considered to address current challenges, such as price cannibalisation, include:

- A decarbonisation obligation on electricity suppliers, requiring them to procure green electricity directly on behalf of their consumers. The government would set a decreasing trajectory of the maximum carbon intensity of electricity that suppliers can sell to their customers and suppliers would contract either directly with generators or through an intermediary. This would differ from past measures such as the Renewables Obligation, as suppliers would have more freedom as to how they meet their obligation.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with the option of a supplier obligation for delivering mass low carbon power as a standalone option but continue to consider it as a potential component of other reforms. See here for more details.

- Retain the current CfD scheme in the long-term.

- Note: this option is still under consideration within the government’s second REMA consultation, with several options proposed to future-proof the CfD scheme. See here for more details.

- CfD variants with increased price exposure either during the length of the contract or shorter contracts to increase the amount of time that generators are fully exposed to market signals. This could include a CfD with a strike price range instead of a single price or changes to the reference price methodology.

- Note: while changes to the CfD reference price methodology are still under consideration, within the government’s second REMA consultation it set out its intention to remove the option for a CfD with a strike price range. See here for more details.

- A CfD revenue cap and floor, under which generators would be guaranteed a minimum revenue in each period. They would compete in the full range of markets (capacity, wholesale, balancing, ancillary services), and if they do not meet their minimum revenue, then they would be topped up at the end of the period. If their revenue was above the cap, a proportion of the excess would be paid back.

- Note: within its second REMA consultation, the government set out its intention to remove the option of having a revenue cap and floor for the CfD. See here for more details.

- A CfD based on deemed generation, in which plants are paid based on their potential to generate in a particular period, rather than their actual generation behaviour.

- Note: this option is still under consideration within the government’s second REMA consultation. See here for more details.

The majority of these options retain competitively allocated, long-term, private law contracts between generators and a government-owned counterparty, as these seem likely to remain the most cost-effective way of delivering investment requirements for Carbon Budget Six. The only option which does not rely on such contracts is the supplier obligation, under which investment would be underpinned by market contracts between generators, suppliers, and intermediaries. While this could lead to a more efficient capacity mix overall, and possibly more business model innovation, it would likely entail additional financing and delivery risks, which would need clear mitigation before this option could be recommended.

However, all options under consideration – apart from the existing CfD – would increase the role of the market, whether through greater exposure of those contracts to prices, or in the allocation of those contracts, in order to minimise costs which are passed to consumers.

Options for delivering flexibility

The government highlighted that flexibility is critical for balancing supply and demand, enabling the integration of low carbon power, heat, and transport, and maintaining the stability of the system. It stated that the current market framework does not maximise the potential for the full range of flexible technologies.

To address these challenges, the government noted that it is taking a ‘twin track’ approach to market reform for flexibility. This includes the need for strong granular operational signals from the wholesale and balancing markets but also the need to ensure flexibility can attract the investment it needs to deploy. The options set out consider whether changes to investment signals would enable greater competition between flexible assets. These include:

- A revenue cap and floor, under which flexibility assets would compete for a guaranteed minimum revenue (floor) from the government for each period, with a maximum revenue (cap) also introduced to protect consumers from excessive profits.

- Note: within its second REMA consultation, the government set out its intention to remove the option of having a revenue cap and floor for flexibility assets. See here for more details.

- Introducing flexible auctions within the Capacity Market, which would be open to all low carbon technologies which meet an agreed set of flexibility criteria.

- Note: this option is still under consideration within the government’s second REMA consultation and is a preferred proposal for delivering flexibility. See here for more details.

- Introducing multipliers to the clearing price within the Capacity Market. Under this option, only low carbon capacity which meets the flexibility criteria would be eligible, and multipliers would be applied to their clearing price valuing flexible characteristics, such as response time, duration of capacity and location.

- Note: within its second REMA consultation, the government set out its intention to remove the option of having a single Capacity Market auction with multipliers. See here for more details.

- A flexibility-focused supplier obligation.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with the option of a supplier obligation for flexibility as a standalone option. See here for more details.

Options for delivering capacity adequacy

The government noted that market arrangements will need to secure investment in sufficient capacity to enable system balancing at all times, even in extreme cases, with recent geopolitical events emphasising the importance of this. The case for change has shown that as the system becomes increasingly dominated by renewables, firm capacity will be pushed out of the wholesale market, limiting the opportunities for these assets to re-coup their costs (“missing money”). As such, ‘significant’ investment is needed to provide replacement firm capacity.

The existing Capacity Market provides a mechanism for ensuring capacity adequacy and has worked well but it does not provide incentives for the kind of low carbon, flexible, firm power needed to complement renewable generation.

As such, a range of capacity mechanisms and other options are being considered:

- Making changes to optimise the Capacity Market for the participation of low carbon capacity, without jeopardising security of supply. There are two main variations of this being considered. This includes separate auctions, where low carbon new build or refurbished assets would participate in separate auctions to the main capacity auction, and multiple clearing prices, where there would be a single auction as there is currently but with different clearing prices depending on capacity type.

- Note: the option for an optimised Capacity Market is still under consideration within the government’s second REMA consultation. It proposes a single auction, with a minimum procurement target (minima) to support investment of low carbon flexible technologies. See here for more details.

- A strategic reserve model where a central authority auctions a certain amount (and type) of reserve capacity on top of what the market is expected to provide, with successful providers receiving payment at their bid price.

- Note: the government decided in its March 2023 summary of consultation responses document that the strategic reserves option will only be considered in conjunction with other reforms. However, within its second REMA consultation, the government set out its intention to remove this option. See here for more details.

- Centralised Reliability Option model whereby the incentive to provide power is signalled through the level of wholesale market pricing rather than by targeting a system stress event. The mechanism is based on the concept of a ‘call option contract’, which gives the buyer of the contract the right to buy a commodity at a predefined price. The Transmission System Operator (TSO) determines the amount of capacity to be auctioned and, in return for a reliability premium secures the right to buy electricity from the assets on the wholesale market at a ‘strike price’.

- Note: within its second REMA consultation, the government set out its intention to remove Centralised Reliability Options. See here for more details.

- Decentralised Reliability Option model, which would work in a similar way to the Centralised Reliability Option model but with the role of the TSO stripped out and suppliers required to secure reliability options to meet their peak demand through direct contracts with capacity providers.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with the option of a Decentralised Reliability Option model. See here for more details.

- Capacity payment model, which is a market-wide approach that sets an explicit price for capacity.

- Note: the government decided in its March 2023 summary of consultation responses document not to proceed with the option of a capacity payment model. See here for more details.

- Targeted tender, which is a centrally coordinated process to secure the construction of a specified quantity of new capacity, which secures a long-term contract, with tenders tailored to meet specific requirements such as location, the type of technology and any additional system services.

- Note: the government decided in its March 2023 summary of consultation responses document that the targeted tender option will only be considered in conjunction with other reforms. However, within its second REMA consultation, the government set out its intention to remove this option. See here for more details.

Options for delivering operability

In the last row of Figure 1, the government set out options for operability. It noted that under the current arrangements, National Grid Electricity System Operator procures ancillary services, mainly from fossil fuelled generators, to ensure they are available when needed. As a large proportion of this will be replaced with low carbon generation, in meeting the 2035 decarbonisation target, the government sets out options to promote investment in low carbon ancillary services:

- Continuing with the status quo.

- Note: within its second REMA consultation, the government set out its intention to remove this option. See here for more details.

- Incremental modifications to existing arrangements. Among other possible measures, this includes giving the Electricity System Operator or National Energy System Operator the ability (or obligation) to prioritise zero/low carbon procurement and aligning Capacity Market and CfD tenders with those for ancillary services.

- Note: within its second REMA consultation, the government set out its intention to remove this option. See here for more details.

- Developing local ancillary services markets and giving a greater role to distribution network operators.

- Note: within its second REMA consultation, the government set out its intention to remove this option. See here for more details.

- Changes to the CfD to remove disincentives for assets supported by the scheme to engage in ancillary services market and changes to the Capacity Market to include obligations or incentives to provide ancillary services.

- Note: this option is still under consideration within the government’s second REMA consultation. See here for more details.

- Co-optimisation of ancillary services, which would be considered as part of broader wholesale market changes which involve central dispatch (dispatch controlled by the System Operator), such as nodal pricing.

- Note: this option is still under consideration within the government’s second REMA consultation. See here for more details.

Options across multiple market elements

The government considered two options which cover multiple elements of market design at once. This includes an auction by cost of carbon abatement, as per the Dutch SDE++ scheme, and an Equivalent Firm Power (EFP) auction. In assessing a cost of carbon abatement auction BEIS was only minded to take this option forward for further exploration as a potential way of structuring support for investment in low carbon flexibility. It was not minded to pursue this option for mass low carbon power, as there does not appear to be significant benefits over the existing CfD scheme.

Note: the government decided in its March 2023 summary of consultation responses document not to proceed with any of these options. See here for more details.

Next Steps

Read about what the next steps are once the consultation closes.